The consequences of identity fraud can be devastating. Fraud, in particular, can be difficult to resolve as a person usually isn’t aware they’re a victim until long after the crime has been committed. For this reason, understanding how to prevent fraud is critical.

To help, we’ve outlined everything you need to know about identity theft and fraud in this fraud protection guide, including:

- The difference between identity theft and identity fraud

- How to prevent fraud and identity theft

- The effect of fraud on your credit score

- How to fix your credit score after identity theft

What’s the difference between identity theft and identity fraud?

These crimes tend to go hand-in-hand. However, there is a difference between identity theft and identity fraud in the eyes of the law. It’s these subtle differences that actually make them two separate crimes.

Identity Theft

This is when your personal information is stolen, usually in the form of financial data or passwords. Identity theft tends to lead to identity fraud, as the stolen information is typically used to gain money.

Identity Fraud

Whilst identity theft is the act of stealing personal information, identity fraud is the use of that stolen data. This not only affects the person whose information is stolen, but also the businesses where the information has been used to make fraudulent transactions.

The consequences of identity fraud are incredibly damaging to your credit score, as fraudsters can secure credit in your name. Therefore hindering your ability to secure credit in the future. Not to mention the detrimental impact identity theft and fraud can have on a person’s mental health.

How can I prevent fraud and identity theft?

Identity fraud leaves a significant and lasting impression on your credit score. The mark left by fraud will follow you around until successfully disputed, so checking your credit report regularly is critical in preventing fraud and identity theft. You should check for any credit or debt that you don’t recognise and contact the lender immediately.

Of course, prevention is always better than cure. In addition to looking out for suspicious activity on your file, it’s equally important to be wary of the common tactics used by fraudsters to trick you into giving away your personal information. Be extra cautious of the following:

- Cold calling

- Redirecting post

- Stealing data from social media

- Planting malicious malware on computers

- Phishing (i.e. sending spam emails)

- Intercepting public Wi-Fi

How to protect yourself from phishing

Scammers will often use emails or text messages to trick you into giving up your personal information. This is known as phishing.

The message may even look like a company you trust and will try to get you to click a link or download an attachment. For example, the content of the message could be any of the following:

- Altering you to suspicious login attempts

- Claim there’s a problem with your account

- Ask you to confirm your information

- Send you a fake invoice

- Inform you about a government refund

- Offer you free stuff or discounts

- An issue with a package delivery

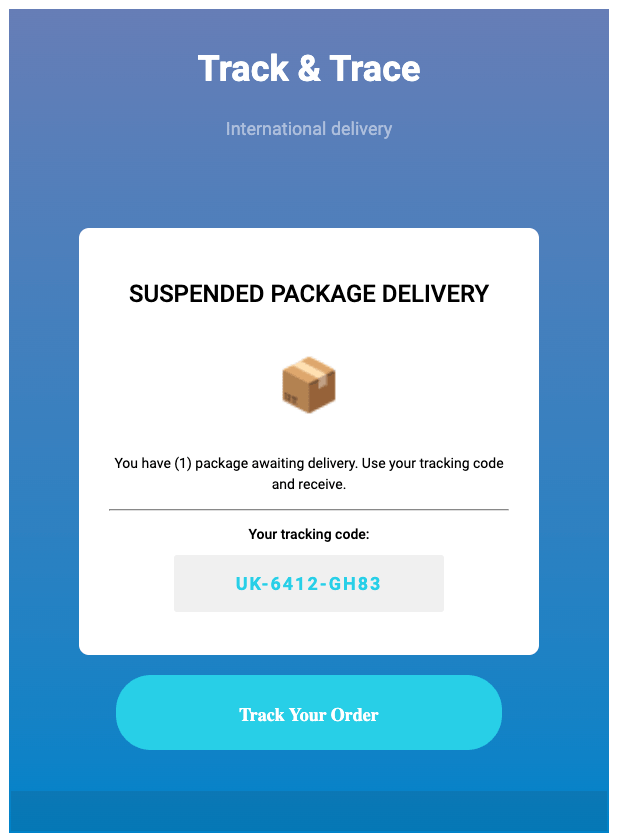

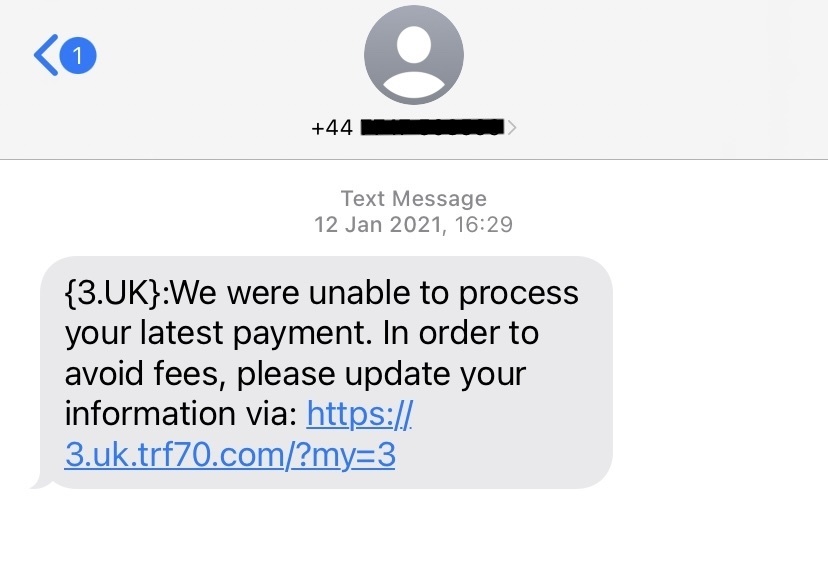

Below is an example of a phishing email and text message.

At a glance, they may look normal enough, but there are some telltale signs.

In the email, there’s no information about the package or who the delivery service is. On the text, whilst it may be the correct phone network, the sender is displayed as a random number and the link is unofficial.

If you’re unsure about a message or an email, do not click any links. Instead:

- Check the email/number as this is usually an obvious giveaway.

- If it’s referring to an account you genuinely have, log into your account directly and check the status there instead.

- Call the company and check, using the contact information on their official website.

There are several proactive steps you can take to help protect yourself from phishing as well. These include:

- Install security software onto your computer, which will pick up any threats you may have missed.

- Set your phone to install updates automatically. Keeping your phone updated allows it to deal with any new security threats.

- Set up multi-factor authentication on your accounts that offer this service. This means you’ll require two or more credentials to log into your account, making it harder for scammers to gain access to your information.

- Back up your data on either an external hard drive or cloud storage.

How to protect yourself from malware

Malware (malicious software) infects your computer and allows criminals to access your system and steal information. The most common way that people fall victim to malware is by downloading programmes from the web or via attachments or links in scam emails.

Anti-malware software

The best way to protect yourself from accidentally downloading malware is to download anti-malware software. This provides a safety net, as you can set it up so that it automatically scans files before they’re downloaded onto your device. You can also set up scheduled scans for ongoing maintenance.

Check before you download

It’s important to be careful when downloading anything from the internet. Ensure any programmes you download are from reputable sources, such as an official app store.

Know the signs of malware

Unfortunately, you could be infected without realising. If your computer is running much slower than normal, programmes keep crashing and/or the performance is generally poor, then you may have malware running on your system.

It’s important to note though that most malware will run quietly in the background, so it can be hard to detect. The best thing to do is to run periodic scans with anti-malware software. Better safe than sorry!

How to protect your identity on social media

With social media being so ingrained in our everyday lives, it can be easy to overlook it as a potential weapon for scammers. Whilst it’s a great place to share our lives with our friends, it’s important to remember that fraudsters can use what you post to steal your identity.

Here’s how you can help protect your data, without sacrificing your social profiles:

- Set your profiles to private

- Don’t accept follower/friend requests from people you don’t know

- Don’t use personal info in your user name, like a birth year or location (eg. Jane_1987 or London_John).

- Avoid oversharing (eg. your holiday dates or IDs)

- Change passwords regularly

- Don’t give clues to your password (eg. using a pet’s name as a password when you’ve posted about your pet).

- Make sure any third-party apps you allow access to your profile are reputable.

How to protect yourself from fraudulent mail redirection

Royal Mail does carry out vigilant checks on mail redirection applications to protect customers against fraud. However, if you suspect that a fraudulent mail redirection has been set up, you need to contact Royal Mail immediately.

To help prevent important documents from landing in the wrong hands, set up paperless correspondence with your banks, lenders and any subscriptions etc. This way there will be less paper mail to keep track of, making it easier to spot if you’re missing any documents.

How to protect your data on public WIFI

The key thing to remember here is that public WIFI isn’t secure. Our advice would be to stick to your phone’s data if possible, as this is much safer. If for any reason you need to use public WIFI, avoid accessing any personal information whilst connected. This includes online banking, emails or any accounts that require you to log in.

Also, remember to change your settings so that your phone doesn’t automatically connect to that WIFI the next time you’re in the area!

Can fraud affect your credit score?

The consequences of identity fraud on your credit score can be devastating. If a fraudster uses your existing credit or applies for new credit, this could leave a footprint of debt and/or missed payments on your credit report.

This, in turn, negatively affects your ability to get additional finance in the future, including new mortgages and remortgages. Sadly, many people don’t realise they’re a victim of identity fraud until they’re rejected for credit.

To put it into context, a single missed payment causes your credit score to drop by around 130 points. Whereas up to six mixed payments can result in defaults. Plus, if fraudsters max out your credit, this makes you a bigger risk in the eyes of lenders.

Additionally, multiple credit applications at once also damage your credit score, even if they’re rejected.

How can I fix my credit score after identity theft?

Unfair as it seems, identity fraud impacts you until it’s resolved. This is why it’s important to keep an eye on your credit report so you can detect any irregularities before they spiral. The good news is that there are steps you can take to help fix your credit score after identity theft and fraud.

Report it to the credit reference agencies

There are three main credit reference agencies in the UK – Experian, Equifax, and TransUnion. Report any suspicious activity to these agencies so they can raise the issue with the relevant lender. It can take a while for your records to be updated, so the sooner the better.

Contact the lender or bank

Always speak to the lender or your bank directly as well. If the fraud involves using your credit, then whether you’re due a refund depends on several factors. You can also raise it with the Financial Ombudsman, who will review the case with an unbiased point of view.

Consider a fraud alert on your credit file

You can set up a fraud alert on your credit report to alert lenders, should any further applications be made. Lenders will know they need to confirm your identity before offering credit, making it harder for criminals to pretend to be you.

Setting up an alert won’t impact your score, but it is a paid-for service. Equifax’s WebDirect is £7.95 per month, whilst Experian’s Identity Plus is £6.99 a month.

Add a Notice of Correction to your credit file

You could also ask the credit reference agencies to add a password to your file. This involves the agency adding a Notice of Correction to your report that includes a password of your choice. This is free to do and means that lenders will ask for the password before approving any further credit.

Report it to Action Fraud

Should you ever fall victim to fraud, Action Fraud can provide guidance to help ensure your situation is dealt with as smoothly as possible. More information can be found on the Action Fraud website.

Where can I check my credit score?

You can usually check your credit score through your bank. Alternatively, the three main credit reference agencies in the UK are Experian, Equifax and TransUnion.

We hope you’ve found this fraud protection guide useful in better understanding the consequences of identity fraud. For help and advice on improving your credit score, book a free consultation with a member of our team.

Comments on Consequences of identity fraud on your credit score

There are 0 comments on Consequences of identity fraud on your credit score