The consequences of identity fraud can be devastating. Fraud, in particular, can be difficult to resolve as a person usually isn’t aware they’re a victim until long after the crime has been committed. For this reason, understanding how to prevent fraud is critical. To help, we’ve outlined everything you need to know about identity theft […]

With house prices increasing and the cost of living crisis at our heels, you may be torn as to whether or not you should put your house-hunting plans on hold. One of the most frequently asked questions we’ve had this year from potential homebuyers is whether now is a good time to buy a house. […]

For many homebuyers, whether first-time or those looking to move up the property ladder, often the biggest challenge is saving the mortgage deposit. The average time it takes first-time buyers to save a 15% deposit has risen by 1.1 years since 2012, according to Yes Homebuyers. What’s more, in the South East of England buyers […]

It could be another interesting year in housing, as we take a look at UK housing market predictions for 2022. Last year, the Stamp Duty holiday, flexible working, and historically low interest rates fuelled a home-buying frenzy. Naturally, house hunters responded by taking advantage of these opportunities to climb the property ladder. So, what’s in […]

When moving house, most will have mastered the art of budgeting and saving to finance the home itself. But when it comes to the actual move, you must factor in all of the additional costs – from Stamp Duty and new furniture to redirected post. Here, we break down the true cost of buying a […]

Keeping on top of essential outgoings – like mortgages and rent – would be tough on most of us if we were to lose our income due to illness or injury. Understanding the options available could make all the difference, including what Income Protection is and how it could help you. In this guide, we’ve […]

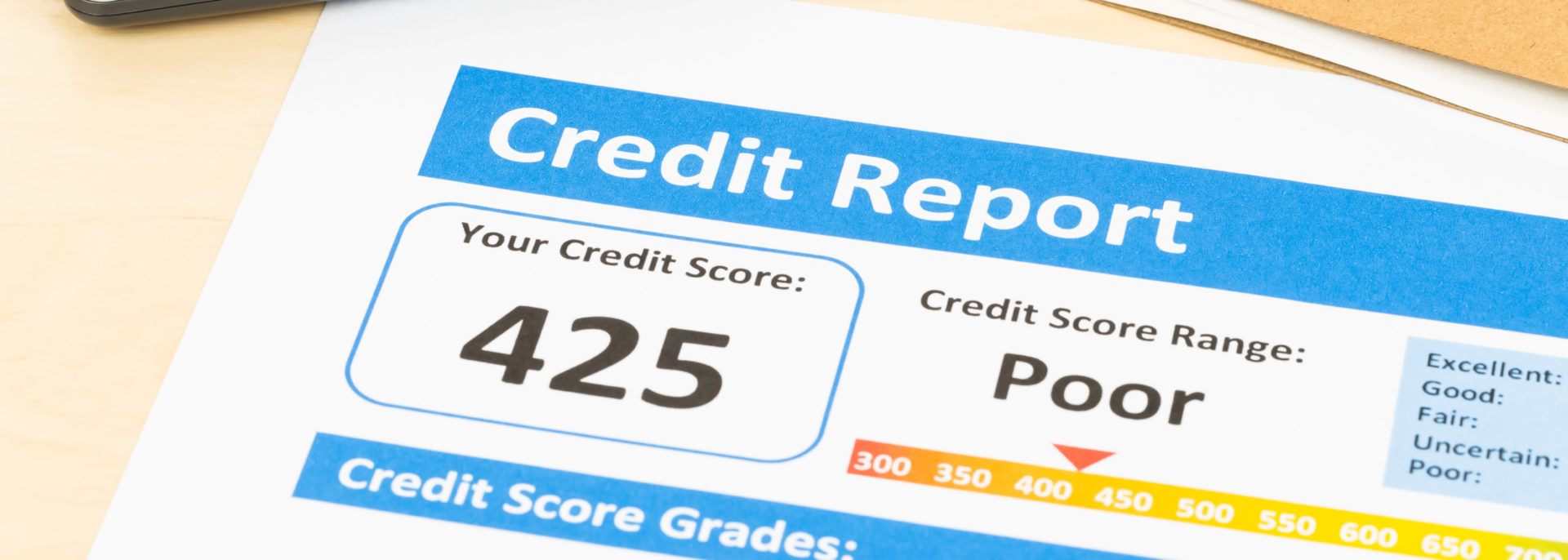

Common causes of a bad credit rating include missing payments, loan defaults and even identity theft. If you’ve found yourself on this page, then you may have been rejected for a loan, credit card or mortgage recently. Or perhaps you’re preparing to make a huge financial commitment and want to ensure your credit score doesn’t […]

Our homes are extremely important to us, and so is keeping them light and warm. Sadly, the energy we create at home through light, heat and general waste can do some serious damage to the environment. The good news? There’s plenty of small, yet impactful, changes that you can make in your own home to […]

When it comes to the different types of mortgages, there are many payment plans and terms available, each designed to cater to your unique circumstances. Factors to consider when selecting a mortgage include: Whether it’s your very first mortgage or you’re remortgaging the family home, we’re here to help you better understand the different types […]